The most important technical indicator for a daytrader

A technical indicator that many do not know so well is VWAP (Volume Weighted Average Price). However, it is a shame if you do day trading and forex trading for that matter, without knowing about WAP. Why is that? Well, that’s probably the most important indicator you can use as a day trader.

An indicator that many do not know is VWAP (Volume Weighted Average Price). However, it is a great pity if you who deal with day trading and currency trading for that matter, do not know about VWAP. Even though there are a myriad of indicators out there and an old motto I follow is “Analysis Paralysis” – do not use too many indicators when trading. The risk is that you expose yourself to an abundance of information and never get shot with an entry and usually for early exits.

However, there is a holy grail when it comes to which indicator I would never trade without and that is VWAP. What VWAP does is give you the volume-weighted average price for the current ongoing intraday trading. VWAP should not be confused with a moving average that weighs only X number of recent opening or closing prices (depending on configuration). VWAP adds up the total traded order value for traded shares by the number of shares traded in total. So you get the true average price.

VWAP is important from the perspective of institutional traders and market makers as they use VWAP as a measure of when it is time to distribute (sell) and accumulate (buy) positions to maximize profits.

As an institutional trader or market maker, you trade large positions that in some cases may require several hours or days to get in and out of unless you want to leave significant traces in the price. In order for this to happen in the best possible way, VWAP is used to help and find the right locations for the accumulation or distribution of these positions.

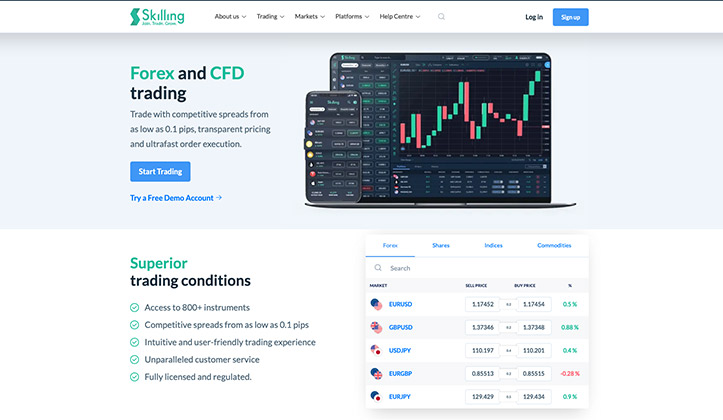

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: Experience MetaTrader, the world’s best platform for trading according to many specialists. Try Skilling now!

Risk warning: 76% of retail investor accounts lose money.

If an institutional trader handles a large order on behalf of a customer, it also usually means a commission for the trader if, say, 500,000 shares in AAPL are to be bought up and the trader can accumulate under VWAP instead of around or above.

As I said, VWAP is an important scale where trading below VWAP is considered bearish and above VWAP is considered bullish. VWAP often acts as a point of resistance or support intraday if the scales are about to shift from bull to bear and vice versa. Imagine that VWAP is like a tide where you hardly want to stay in a short position if the price suddenly breaks up through VWAP and trades over. This is a strong indication that the power has changed. Do not stand in the way.

VWAP can NOT be used as an indication that a share is oversold or overbought. There is no indication that the price will return to VWAP if it is traded far over. It is rather just an indication that there is strong purchasing power. Vice versa for a share that is sold heavily and is far below.

A pure intraday indicator

VWAP is a pure intraday indicator that is reset every trading day. There are clever variants of VWAP that link the volume-weighted average price over longer periods. But these are not as common.

See attached pictures of graphs where VWAP is included and see how the price respects VWAP as a support / resistance and situations where the price has gone from one side to the other and really changed the current.

$ DPW which I myself bought a few weeks ago (see picture) closed the first 5 minutes during VWAP which gave me a second chance for entry instead of Pre-market highs which was intended from the beginning. Once the price has chosen its side about VWAP (of course a lot of other factors as well, of course), it usually stays there for a majority of the trading day.

Where’s the volume?

Not all brokers report the volume, mainly due to the fact that there is not really a central compilation. However, there is a way to solve this with the forex brokers who are at the forefront, for example Skilling, Pepperstone and IC Markets. They offer cTrader.

cTrader is one of the world’s leading platforms for forex trading and online trading, and the biggest competitor to MetaQuote’s popular MT4 and MT5 platforms. cTrader is the Cypriot financial tech company Spotware’s most flagship product, which since its launch in 2010 has gained market share on the assembly line and is today used by millions of traders worldwide. Try cTrader with Skilling today!

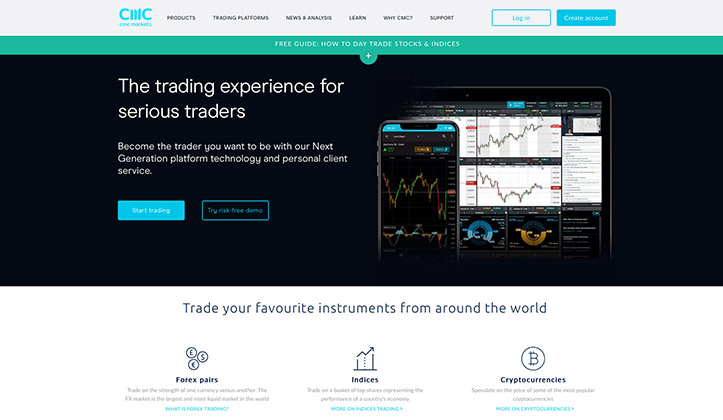

Minimum deposit: Unlimited

Description: Become a better trader with CMC Markets. Try a free demo account today!

Risk warning: 69% of all non-professional clients lose money on CFD-trading with this broker.

cTrader is a trading platform specially developed for online trading in various types of financial instruments. Through cTrader, users can both invest and speculate in assets including currencies, stocks, stock indices, commodities and other exchange traded products with CFDs. cTrader is not a broker in itself, but stands instead for the technology and systems through which brokers who do not have a self-developed platform (alternatively also want to offer a third-party solution as a complement) can enable trading for their users.

The basic offering in cTrader consists of more than 70 built-in technical indicators free to use for analysis. In addition to this, there are also lots of additional tools to add, either by building them yourself or choosing from already ready-made alternatives. Volume thus exists as an indicator, and through this VWAP is then obtained. You can register with Skilling here or go to their cTrader page here! You automatically get a demo account to try.

Published:

Author: Erik Forsell

TAGGAR

Other similar news

Below you can see more similar news if you want to learn more about this subject or find related topics.Everybody knows there's a war going on in Ukraine, Russia is trying to take over the country and the...

Recently we've seen headlines all across the globe shouting about how Russia is preparing to invade ...

It's been roughly 2 years since the start of the Corona pandemic, one of the biggest events in moder...