GBP Live Rates: Pound Sterling in Real Time!

The pound sterling, simply sterling or Pound as commonly referred to by many people, is one of the most powerful currencies in the world today. The high value of the pound sterling makes sense and is justified – but it may come as a surprise for you, especially if you do not live in the UK or travel much. If you are curious about the latest movements for GBP, you came to the right place with real time GBP rates, where to trade sterling and factors to consider while trading.

For people coming from the UK to travel to other countries, the high value of the currency can be such a massive boost for their wallets. However, it may not be so great for your pockets if you live abroad and want to travel and spend your hard-earned money in the UK.

There are a handful of variables that influence exchange rates. But, what are the specific reasons behind the high value of the Pound? Some of the reasons behind the high exchange rates for Pound Sterling include: Inflation, interest rates, speculation and sentiments. These are a few of the primary factors that contribute to the high value of the Pound in the exchange market. However, other financial institutions such as the Bank of England and the European Central bank have a hand in the currency’s exchange value. Learn more in our Forex Trading School where over 50 factors are mentioned. See live rates for GBP below:

GBP/USD

EUR/GBP

GBP/AUD

GBP/JPY

Table of Contents: Overview

- 1 Live Rates for Pound Sterling

- 2 Factors to Consider When Trading British Pound

- 3 So, what is the best time to trade sterling?

- 4 British pounds for forex trading

- 5 How to invest or speculate in GBP

- 6 Best Time to Trade the British Pound

- 7 Future Outlook of the British Pound

- 8 Interesting Facts about Pound Sterling

Live Rates for Pound Sterling

Like any other currency, the live exchange rates for British Pound are constantly changing. Some of the factors contributing to the variation in the Pound sterling live rates are (a) Inflation that occurs throughout the world and (b) Varying interest rates from one country to another.

As live rates for the British Pound are constantly in flux, due to changes in the foreign exchange market, they may adjust from one minute to the other. The rate you get as a consumer is often determined by the institution or bank you choose for money transfer.

A bank or financial institution that uses live exchange rates allows you to see what is going on at any given time. It is also possible to check the live exchange rates using online currency converter tools and monitor the variation throughout the day. But, how does Pound Sterling compare to other currencies in the market?

GBP/USD

If you are a regular in the currency exchange market, you might have come across GBP/USD pair. That is because it is among the most widely traded currency pairs in the world. But, what exactly does GBP/USD mean?

GBP/USD, or British Pound/US Dollar, is a short form for the Pound Sterling and United States dollar currency pair. In this case, the ‘GBP’ is the base currency, while ‘US dollars’ is the quote currency. In the most basic dictionary definition, GDP/USD informs the reader how much US dollars are needed to buy one British Pound.

The exchange rate of GBP/USD is often affected by elements that influence the value of the British Pound and or the US dollar. That is the primary reason why a rate differential between the Federal Reserve and the Bank of England would significantly affect the value of both currencies in an exchange.

EUR/GBP

In this case, the ‘EUR’ is the base currency while the ‘GBP’ is the quote currency. This currency pair is also among the top 5 most widely traded pairs in the exchange market today.

EUR/GBP currency pair indicates the amount of British Pounds required to purchase 1 Euro. For instance, if you see EUR/GBP price is 0.86, it indicates that a Euro exchanges for 0.86 Pounds Sterling. Or, 0.86 sterling pounds is worth 1 Euro.

This currency pair is part of the Minor forex Pair category. European and British forex traders are interested in the EUR/GBP currency pair, primarily since the Brexit decision has significantly influenced all the currencies involved.

GBP/AUD

The forex ticker GBP/AUD indicates how many Australian dollars are required to buy one British Pound. The Australian Dollar is the fifth most traded currency in the market today. Therefore, you might have come across GBP/AUD currency pair at some point.

The Australian Dollar has a comparatively higher interest rate and strong connection with the global equities market. For that reason, it is commonly referred to as a risk currency. The GBP/AUD price is expected to increase as mining, which is the Australian largest economy sector, faces challenges.

Some of the factors contributing to the negative impact in the Australian mining sector include a downturn in the global commodity supercycle and the decline in China’s growth.

GBP/JPY

Like the others, GBP/JPY is a forex ticker for the exchange rate between Pound Sterling and the Japanese Yen. The Japanese Yen is the third most traded currency globally, while the pound sterling takes fourth.

There is a wide range of reasons why the GBP/JPY currency pair is commonly traded in the market. However, volatility and carry trade are the leading reasons.

Factors to Consider When Trading British Pound

As we already mentioned, the Pound Sterling is one of the most expensive currencies in the market today. That is because of a wide range of reasons, including inflation, speculation among other factors. But why should you trade GPB?

The primary reason you should trade British Pound is that it is a reasonably stable currency. For that reason, it is rare to find its value, against the other currencies, fluctuating up and down more than 1% in a single day. Therefore, it is safe to consider it a haven even if Brexit might change that.

However, before you start trading the British Pound, it is essential to consider these factors;

Monetary Policy

As a trader, it is essential to monitor monitory policies enacted by the Bank of England. The BoE uses these monetary policy tools to control the inflation of the Pound Sterling to ensure its stability in the market. If the bank feels inflation or confidence in the currency threatens its stability, it will deploy the necessary monetary policies to restore everything to normal.

Prices and Inflation

Another thing to check out as a trader is price and inflation, as these two play a crucial role in the value of the British Pound. As we already mentioned, the BoE would employ monetary policies to restore the stability of the Sterling in case of inflation. Therefore, you should gauge inflation levels using the Consumer Price Index (CPI) before trading British Pound.

Any deviation from the BoE’s inflation target results in the implementation of monetary policies. Therefore, an intelligent trader should constantly monitor inflation.

UK’s Economic Growth

Another thing you should consider as a trader is the UK’s GDP (Preliminary GDP, Revised GDP and Final GDP). The gross domestic product gives you an insight into the economic health of the UK. Since general economic health impacts the value of currencies, it is essential to monitor all the three different GDPs when trading British Pound.

So, what is the best time to trade sterling?

If you want to make significant profits trading the Pound Sterling, it is crucial to understand the best times to trade.

Theoretically, you can trade the Pound Sterling at any time as the foreign exchange market is a round-the-clock market. Whenever the forex exchange market is open, it provides an excellent opportunity for profits. However, volatility varies significantly within each 24-hour cycle.

The best time to trade the British Pound depends on the currency pay you intend to trade. For instance, 9 am to 4 pm, when the European markets open, is the best time to trade EUR/GBP. If you want to trade GBP/USD, you should trade between 1 pm and 5 pm, when the US and British market overlaps for a few hours, resulting in high volatility.

British pounds for forex trading

Britain’s international position as a major economic power means that the British pound long had a firm place on the list of the world’s most popular currencies to trade. After USD, EUR and JPY, GBP is the fourth most traded fiat currency, and is usually traded in pairs with US dollars, Euros and Yen – but of course also in more exotic constellations such as GBP/PLN and GBP/TRY. Compared to the EUR/GBP pair – which offers excellent liquidity as well as large volumes and which was also recently named one of the hottest forex pairs to trade right now – GBP/USD is usually a bit more volatile to trade because the liquidity in the pair is not really reaches the same level as for many other currency pairs.

One should therefore be prepared for more noticeable fluctuations in both directions, especially in direct connection with the release of news, reports and other economic data. With that said, of course, the GBP/USD is one of the most traded currency pairs in the world – with the weight that also comes with it.

How to invest or speculate in GBP

British pounds are traded at all online forex brokers, and it is possible to speculate as well as invest in GBP. In order to optimise your trading and give yourself the best conditions to analyse, plan and hopefully succeed with the trading – it is of course important to keep track of the economic indicators that are important for how the GBP exchange rate develops.

Monthly interest rate decisions from the Bank of England, inflation letters sent about inflation that 1% away from the inflation target (including those from the central bank), consumer price indices, various PMIs and the so-called U.K. Claimant Count is good to keep an eye on whether you trade short-term or long-term. The U.K. Claimant Count is an indicator that monitors the UK’s unemployment figures on a monthly basis – a good statistic to follow as the general employment rate among the country’s residents is of course one of several factors affecting the exchange rate.

Rating: 9.78/10

Minimum deposit: 50 GBP

Description: Trade GBP from Skilling. An innovative online trading broker with a user friendly interface. Try today!

Risk warning: 68% of private investors lose money when they trade CFDs with eToro.

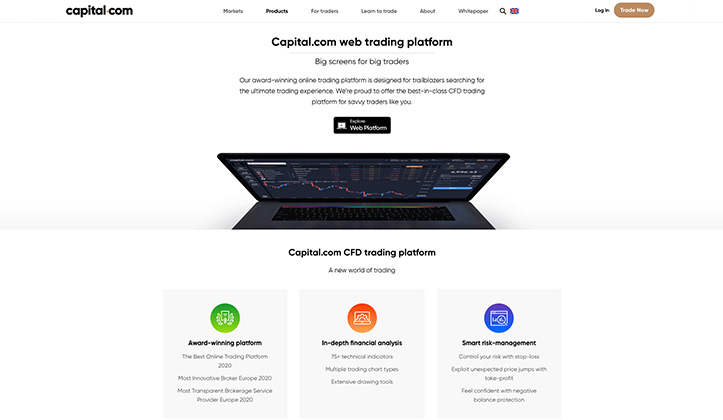

When it comes to forex brokers, there are lots of really good alternatives to choose from. In addition to eToro, they are the professional site Capital which is popular both internationally and among the British. They offer advanced forex trading with as many as 20 different GBP pairs – including GBP/USD, GBP/JPY, EUR/GBP, GBP/CAD and GBP/AUD to name a few.

Thanks to its intuitive interface, lightning-fast executions and generous offerings, the platform has achieved great success since it was founded in 2017. Capital is an excellent choice for you who want to get started trading forex with GBP. Capital also has flexible leverage, which allows you to trade pounds without leverage, or with leverage – the choice is yours.

Best Time to Trade the British Pound

The foreign exchange market is theoretically a round-the-clock market, which is why GBP can more or less be traded at any time. However, some times seems to be more liquid than others – for example 9.00-16:00 if you trade EUR/GBP when the European markets are open, or between 13:00-17:00 if you are trading GBP/USD because the British and the The US market then overlaps for a few hours, with most volatility as a common result.

Future Outlook of the British Pound

In early 2020, the UK finally left the European Union after many years of Brexit negotiations. However, against all odds, the Brexit deal has not significantly impacted the Pound’s value in the exchange market. However, research by the centre Research Centre UK indicates that the impacts of Brexit would affect the economy gradually and permanently. It further estimates the effect to a total decrease of about 5% over a 15-year span.

At the same time, current growth estimates indicate that the British economy will grow faster than most western markets. Since the inflation is picking up, BoE are also getting ready to increase the interest rates which could strengthen the sterling. Apart from that, Brexit has undermined some international investors’ faith in the UK. As we know, international investors can affect the economy of a country. Therefore, a reduction in their number can negatively affect the value of Sterling in the long run.

Keen on trading British pounds? Try Capital, one of the leading forex trading companies when it comes to sterling.

Rating: 9.67/10

Minimum deposit: 250 GBP

Description: Handla GBP hos Capital, en av branschens mest intuitiva plattformar för aktiv trading. Kom igång på någon minut!

Risk warning: 75.26% of retail investor accounts lose money when trading with Capital.

Interesting Facts about Pound Sterling

The British Pound has an ancient history that stretches back several centuries. The currency gets its name “Pound Sterling” from early 775AD in Anglo-Saxon England, where the Pound was a unit currency equivalent to one pound weight of sterling silver.

Since its inception, the name has been used to indicate the Sterling and distinguish it from other pound currencies in the exchange market. There have been various reforms on the Sterling over the years, with the most recent changing the value of a pound from 240 to 100 pence.

The Pound Sterling is also an official currency of Scotland, Northern Ireland, Gibraltar and Tristan de Cunha, among others. Pound banknotes first circulated in England shortly after the BoE was established in 1694. The notes were handwritten at that time. Until the decimal system was introduced in 1971, the sterling Pound ran on a sophisticated system of shillings and pennies.

The currency is mainly issued by the Bank of England, but as the pound is also the official currency in Scotland, Northern Ireland, the so-called Crown holdings of the Isle of Man, Bailiwick of Jersey and Bailiwick of Guernsey and the British holdings and protectorates of Gibraltar, Saint Helena, Ascension, Tristan da Cunha and finally the Falkland Islands – seven other commercial banks and local governments also have the right to issue the currency.

Royal Bank of Scotland, Bank of Ireland, GFSC and Government of Gibraltar are some of the players authorised to issue GBP.