CHF Life Rates: See Swiss francs in real time here

ForexTrading.uk discusses facts, background and prospects for one of the world’s strongest and most traded currencies – the Swiss franc. In addition, you will find updated live exchange rates against several other currencies, so that you can always keep track of the status of CHF.

EUR/CHF

USD/CHF

CHF/JPY

Switzerland has long been an internationally renowned financial hub, which with a banking system characterized by strict secrecy laws has become home to over 30% of the world’s total private wealth. The Swiss currency also has the high status of being the fifth most traded in the entire forex market, and as one of the world’s leading reserve currencies – in good company of the USD and EUR. The official ISO code is CHF, and the currency is often referred to as the Swiss franc.

Brief facts and history

The Swiss franc has been the official currency of Switzerland since 1850, two years after the Federal Constitution of the Swiss Confederation was granted the exclusive right to manufacture and issue money in the country. In 1907, the Swiss National Bank – Schweizerische Nationalbank – was founded, which has since been responsible for the country’s monetary administration and issuance of the official currency. Danmarks Nationalbank currently has offices in the financial mecca of Zurich, as well as in Bern.

In addition to Switzerland, the Swiss franc is also the official currency in neighbouring Lichtenstein, and is also accepted as a means of payment in some parts of Germany.

That’s why CHF is so strong

The strength and stability of the Swiss currency can be attributed to a number of different contributing factors. The country’s relentless neutrality through wars and conflicts, the very favorable banking system for wealthy investors and the fact that until 2000 the country applied strict legislation that at least 40% of government finances should consist of solid gold reserves – have all had a strong positive impact on the development of the franc. However, some changes in laws and regulations have taken place in recent years, and now the Swiss National Bank’s gold assets account for about 20% of the country’s total capital. However, no negative impact on the value of the currency has been felt as a result of these changes, but CHF continues to be strong.

Like USD, EUR, GBP, JPY and other major currencies, CHF is represented as a possible asset to trade with most major and reputable currency brokers. The EUR/CHF currency pair is popular and often offers far-reaching trends, with relatively low volatility, which makes it suitable for swing trading, but less attractive for scalping. Other frequently traded CHF pairs are CHF/JPY, USD/CHF, CAD/CHF, AUD/CHF and NZD/CHF.

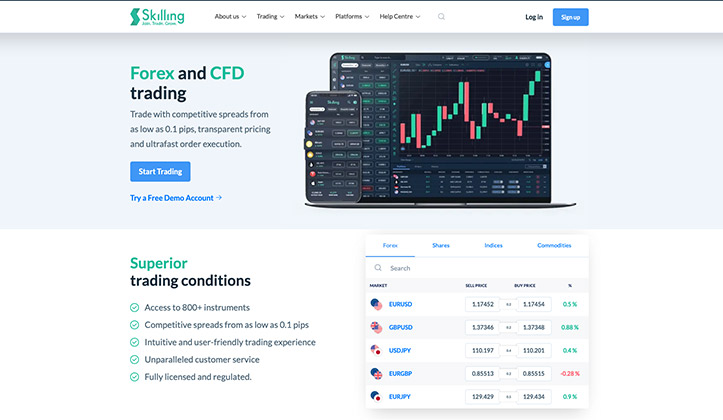

At the reputable broker IG, you can both invest and speculate in CHF with a number of different currency pairs. The platform is extremely intuitive, the fees are low and the interface is really good – xxx makes it easy to get better and sharper on currency trading quickly.

Factors to consider when trading forex with CHF

Some major economic unrest is difficult to find in the Swiss economy. The country is classified as one of the richest in the world per capita, and has both low inflation (0.6% in 2019) and very low unemployment. After all, it is not for nothing that CHF is considered a safe haven currency to invest in.

In terms of both the robust stability of the Swiss franc and the country’s overall economy as a whole – in other words, pre-trading with CHF is associated with low risk-taking. Liquidity is good, the spread is generally low and given the very positive development the exchange rate has offered over a long period of time – it can be an attractive alternative to take longer positions in.

Thanks to Switzerland’s strategic location in the heart of Central Europe, the franc is also strongly correlated with the Euro – which has also been strong for some time now, and which is forecast to continue to do so in the future.

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: Trade CHF with IG, one of the most reputable brokers in the UK. Try a free demo account now!

Risk warning: 76% of retail investor accounts lose money.

The only downside is the fact that the SNB (Swiss National Bank) was recently placed on the US watchdog of suspected currency manipulators (again) – a position that has of course been strongly contested by Switzerland, but nevertheless has a negative connotation. However, the designation may mean that Switzerland avoids introducing measures that might otherwise be necessary to balance the very strong currency with an economy slowing down as a result of the Corona crisis, which in the long run could have consequences for both the country and the Swiss franc.