NZD in Real Time: Live Rates for New Zealand dollar

The world’s tenth most traded currency and a heavyweight in the international foreign exchange market. Here you get to know more about the New Zealand dollar, the country’s economic outlook for 2021 and beyond, what affects the exchange rate and where you best trade NZD. Also look at the live exchange rates, to follow the development towards a number of other currencies – directly in real time. Join Forex Trading as we discuss NZD.

NZD/USD

AUD/NZD

EUR/NZD

Table of Contents: Overview

Forex trading with NZD

The New Zealand dollar is popular to trade with in the short term, as well as to invest in for a longer period. The currency is included in the standard range of almost all serious and professional currency brokers, and can usually be traded in a number of different pairs – both larger and smaller, more exotic ones.

When pre-trading, whether you want to trade NZD or any other currency, you always read the live prices from the back and forth when you want to know how much you have to pay for a currency. The prices above show, for example, that USD 0.64734 is needed to buy 1 NZD, and that 1 AUD costs 1.06635 NZD. At currency brokers, both the selling price and the buying price are shown in separate columns, and the difference in price between buying and selling is what constitutes the spread itself – ie the fee you pay to trade a currency pair.

Background facts and history

The New Zealand dollar has been the official currency of New Zealand since 1967-1969, when it replaced the former national currency – the New Zealand pound. The money is issued by the Reserve Bank of New Zealand, and is available in denominations of 5, 10, 20, 50 and 100 NZD (banknotes) and 1 and 2 NZD (coins) respectively and finally the subunits 10, 20 and 50 cents which are also coins.

The New Zealand dollar is abbreviated NZD in the foreign exchange market, where it is also nicknamed “kiwi dollars” or “kiwi”. A nickname it received mainly for the purpose of being able to easily distinguish it from the US dollar.

In addition to the home country of New Zealand, the NZD is also the official currency of the Cook Islands (which also has its own currency, the Cook Islands Dollar) and of the Niue, Pitcairn and Tokelau archipelagos. Taken together, these areas are part of a kind of monetary union centralized around the NZD.

The New Zealand economy relies heavily on the country’s exports of raw materials. New Zealand advanced greatly in the agricultural industry in the 19th century, and is still classified today as a distinct agricultural country. The dairy, livestock and wool industries are major sources of income for New Zealand and thus also some of the most essential pillars for the country’s economy as a whole.

Given this, the New Zealand dollar is what is commonly referred to as a commodity-heavy currency. The price is affected by and largely reflects the situation in the country’s raw material industry and export markets, which is why it is of course important to keep up to date with the situation in these markets and how New Zealand exports are doing. Other commodity exchanges, such as oil and precious metals, do not significantly affect NZD as the country lacks such assets.

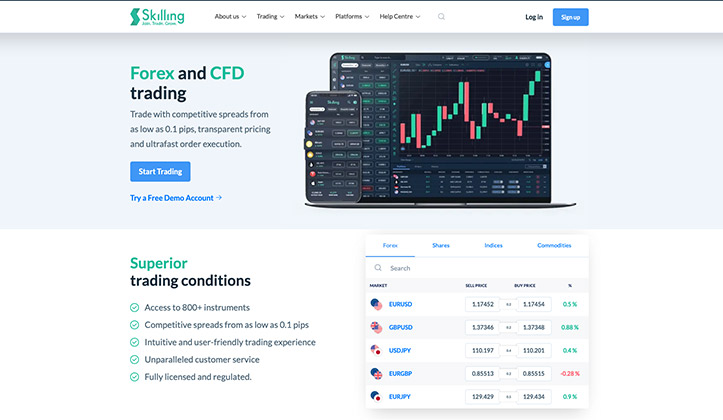

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: Trade NZD at Skilling, New Zeeland’s fastest trading broker in 2021. Get started with a demo account in less than 30 seconds!

Risk warning: 76% of retail investor accounts lose money.

Other economic indicators to keep track of

The New Zealand economy is generally both strong and stable, with annual economic growth of around 3%, and only 3.9% unemployed. Inflation was the highest in 10 years and came in around 4.9% in September 2021, according to RBNZ. The country is spared major geopolitical conflicts and unrest. As with other currencies, key figures such as inflation, GDP, CPI, repo rate and unemployment are important to keep an eye on in order to be able to analyze the exchange rate development for the NZD.

The outlook for NZD in 2021 and beyond

Decisive for many countries’ economies in 2020-21 is how hard the consequences of the Corona pandemic hit, so also for New Zealand. Like neighboring Australia, New Zealand has succeeded in limiting the spread of the virus very successfully, albeit with severe economic consequences. New Zealand chose a strict path in the fight against Covid-19, and issued a strict lockdown that has not least hit the important tourism sector and the trade sector very hard. Experts predict that the country’s economy could suffer a decline of as much as 20% in 2020 – as a direct result of the pandemic. With regard to NZD, Valutahandel.se recently reported that Australia and New Zealand Banking Group Ltd (ANZ) predict a strong short-selling opportunity for the currency pair NZD / USD, as it is considered that the outlook for NZD remains gloomy for the rest of 2020. NZD / USD traded today at historically high levels, but according to ANZ, a decline is definitely to be expected. At the end of the year, the NZD / USD is estimated to be trading around 0.55 – compared to almost 0.65 at present.

At Skilling, you can trade New Zealand dollars at a record low spread and with fast executions. In addition, it is quick to get started with forex trading on the professional platform – register simple and quick for a free demo account and enjoy their user friendly trading platform.