RUB Live Rate: Russian Rubels in Real Time!

Sanctions from the United States, fluctuating oil prices and an ongoing political game – all important factors with a major impact on the value of the Russian ruble. Interested in trading with RUB? Then you will find everything you need to know about the currency here. Take part in RUB live courses in real time, read about which indicators you should be aware of, what its future prospects for 2021 really look like and where and how you best invest – or speculate – in the Russian ruble.

EUR/RUB

USD/RUB

Table of Contents: Overview

Trading with Rubel

The Russian ruble (formerly the Soviet ruble) is today the official currency of Russia and South Ossetia and the Republic of Abkhazia – two breakaway republics that have been recognized as formal republics by Russia itself and a few other countries, including Nicaragua and Venezuela. Despite Russia’s surface, the currency is not one of the most traded in the international forex market – but is usually still among the range of most currency brokers, often in pairs with classics such as USD, EUR, CHF and even krypton BTC.

The EUR/RUB and USD/RUB currency pairs are the most traded, and for USD/RUB in particular, the exchange rate has gone both up and down a bit during 2021. At present, the US dollar is trading at just over 68.3 rubles – a marked increase compared to just a few months ago when the price was instead just over 73 RUB for 1 USD, with a support level around 72 and a resistance of 75-76.

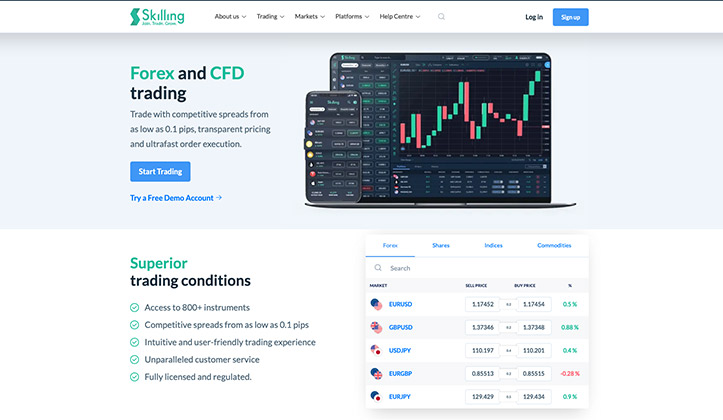

Stabilisation of the Brent oil price combined with extremely strong pressure on US WTI oil, continued trade disputes between the US and China and a massive Corona wave in the US are all considered by experts to be contributing factors to the positive development of the ruble. Maybe an investment situation is in sight? At Skilling, you can trade RUB in pairs with a number of different currencies, at competitive spreads and with a variety of tools and indicators to help you. Start with a demo account and get started with your currency trading quickly, completely without risk and completely without cost.

Indicatorer to keep track on

As one of the world’s leading oil-producing countries, both the Russian currency and the Russian economy are largely very strongly correlated with what is happening in the oil market. The ruble is thus what is usually called a commodity-heavy currency, the value of which is significantly affected based on the prices of Brent oil. If you want to start trading rubles, it is therefore important to keep up with what is happening in the oil market, in order to be able to lay out strategies and analyze in a correct way. This became not least clear in the spring of 2020, when the world’s oil markets were paralyzed by one of the worst crashes in modern times – and the ruble plummeted with a 30% drop in value against the USD as a direct result.

In addition to oil and major geopolitical events, there are of course a number of domestic indicators to keep track of when trading with RUB. How Russia’s central bank parries increased inflation, handles the repo rate and how the figures for the country’s consumer price index are is good to get acquainted with – as well as forecasts for unemployment, exports / imports and current government debt. Domestic policy may be all the more difficult to gain insight into, but in relation to other factors, it is also considered to have a smaller influence over the value of the ruble.

An exchange rate characterised by uncertainty

Russia is still regarded by the outside world as both a political and military superpower, and although President Putin has made no secret of his grand plans to make the country an economic superpower as well – things have gone a little slower on that front. Economically, Russia has experienced a couple of really lean years, perhaps especially since the decision was made to invade Ukrainian territory and take the Crimean peninsula in 2014. Strict sanctions, a sharply weakened oil market, high interest rates and red flags for rampant inflation have all had consequences for the ruble. value in recent years. In the last 10 years, inflation has fluctuated between 3-16%, the repo rate has been anywhere between 5 and 17% – with an average value of around 7% – and unemployment has fallen from 10% during the financial crisis in the 00s, to just over 5% right now.

Rating: 9.56/10

Minimum deposit: 100 GBP

Description: Trade RUB as CFDs with Skilling. Get started with a risk free demo account now!

Risk warning: 76% of retail investor accounts lose money.

The ruble’s prospects for 2021 and forward

After an unstable start in 2020, many experts believe that the absolute bottom of the ruble was reached at the crash in mid-March 2020 – and that there are many indications that the currency will most likely continue to gain ground against the dollar even in the second quarter of 2021. Russia’s economy is also basically relatively strong. However, there is of course some uncertainty – the economic sanctions remain a heavy burden, and as long as the pandemic of Covid-19 continues with consequences for global demand for oil, it is important as a currency trader to follow the development of the ruble closely. Whether Putin’s ambition to make Russia the world’s fifth largest economy will succeed remains to be seen.