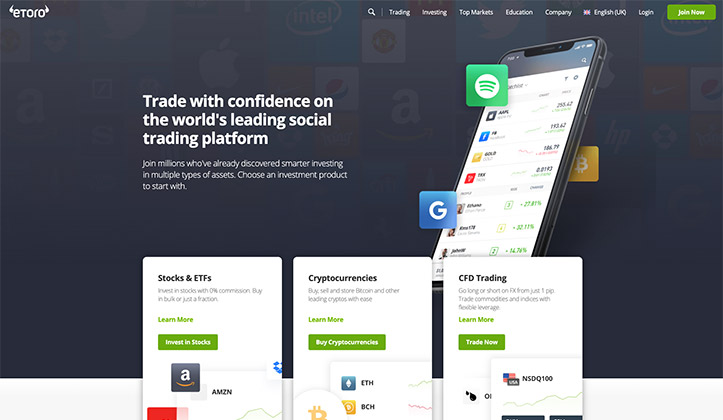

This is how Etoro simplifies crypto & currency trading from August 2021

Etoro does everything to simplify forex trading for trading-hungry individuals. From August 2021, it is possible to get started with eToro from only 50 quid. Yes, you read that right. Fifty sterling pounds is all that’s needed.

A low limit as a first deposit means that significantly more new traders try forex trading, crypto trading or online trading, something that eToro is well aware of. With as many as 20 million registered customers, the next goal is to reach 30 million and to reach this goal, a significantly lower deposit limit is required, which is now a fact. Tired of waiting? Try eToro risk free with a demo account, or continue reading below to learn more.

Table of Contents: Overview

Etoro lower the deposit limit to 50 GBP

In an effort to attract even more customers, eToro is now lowering its limit for the minimum deposit, which will be £50 from August 2021. The previous level was £300, so it is a significant easier for anyone who wants to get started with an international currency brokers that are available worldwide and have been improved for over 15 years. Of course, it is always good to have some extra in the account, so you can handle fluctuations in the market. By investing more, you have at least got a slightly better margin for volatility in the market. But of course it is always good if you reach above the previous minimum level since there were good reasons that they had a bit higher limit earlier. Anyway, if you just want to invest the minimum – £50 is the limit in the UK now! What are you waiting for? Get started with eToro from only £500 – try now!

Why is eToro so secure?

As the only site for trading within the EU, eToro has a huge insurance of up to 1 million EURO per customer. Yes, you read that right – 1,000,000 sterling per customer. eToro has bought insurance from Lloyd’s of London for its customers. The insurance covers claims from eligible customers to eToro (UK) Ltd who incur losses if eToro is in all likelihood insolvent and in the event of irregularities in accordance with the applicable, applicable definition in their policy.

The insurance cover:

(i) up to EUR 1 million for Britons or those coming from the EU.

(ii) up to the total level purchased by eToro and

(iii) is subject to a deductible (as defined in the applicable policy).

The insurance covers cash, all CFD positions and securities. Please note that trading in cryptocurrencies (non-CFDs) is not covered by the insurance, as stated in the applicable policy. It seems like cryptocurrencies are simply too risky to insure.

Rating: 9.78/10

Minimum deposit: 50 GBP

Description: Trade with the market’s perhaps safest trading site, which is listed on Nasdaq & which has insurance up to 1 million euros. Try eToro with demo account now!

Risk warning: 68% of private investors lose money when they trade CFDs with eToro.

What is so unique with eToro?

The company is listed on Nasdaq in the USA, which no other trading company can boast of. We wrote about how Etoro came to Nasdaq on our Swedish site and will soon tell you about perhaps the most unique thing about eToro.

eToro is the original of copy trading, which was created and then imitated by some others who, however, did not succeed as well at all. The reason is that there are millions more customers at eToro than the nearest competitor, which makes copy trading easier. You can choose from wide range of traders, with all types of risk levels and asset classes. With others such as Skilling Copy or AvaSocial, you don’t even get close to the same selection that can be used for copy trading purposes.

eToro allows you to either copy specific persons, or portfolios that go in a certain direction. My own favourite is to select CopyPortfolios, so called copied portfolios that are built up around an idea, results or algorithm. You can try here.

How do you find the right one then? You can sort by popularity, number of new followers, amount invested, annual return, number of profitable months, risk points (1-9), largest decline in a week or annual change in value. You can also filter based on asset classes, so you eg only run crypto, or a mix of different assets, or definitely have no crypto at all. You choose.

In addition, eToro’s offering is magnificent: 258 ETFs (exchange traded funds), thousands of shares worldwide, which can be traded with or without leverage, 31 commodities and 49 of the most traded currencies. It’s hard to beat that? Or try trading for yourself. We suggest that you sign up for a free demo account at eToro and try what’s available.

Exciting copy trading portfolios

Some of the most interesting portfolios include the EV portfolio “ Driverless “, the portfolio for Digital Money called “Future Payments“, a portfolio that only invests in drone stocks called “DroneTech” as well as 5G-related stocks that can be traded using the 5G Revolution portfolio . Another exciting portfolio is “Dividend Growth“, which tries to find stable companies with increased dividends, as well as the Internet security portfolio called “CyberSecurity” at eToro. All of the above have only 4-5 at risk level, on a scale of 1-9.

You can register an account here and try on the site completely risk-free, with a demo account to get warm in your clothes. Once you have registered, you can search for all portfolios that are available to all logged-in customers.

Which cryptocurrencies can be traded easily or automatically?

Some of the 30 or so cryptocurrencies available to trade at eToro include Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), XRP, DASH, Litecoin (LTC), Cardano (ADA), Miota (IOTA), EOS, Tron (TRX), Binance Coin (BNB), Tezos (XTZ), Algorand (ALGO), Shiba (SHIBxM) and Polygon (MATIC). If you prefer to trade automatically, it may be appropriate to check out crypto portfolios such as CryptoEqual (451% return with risk level 8/9), CryptoPortfolio (460% return with risk level 8/9 or Crypto currency portfolio with 390% return de last 12 months with a risk level of 7 out of 9. If you want a slightly lower risk level, otherwise CryptoTakeover with 162% return and risk level 6 out of 9 may be an option, but keep in mind that previous returns are not a guarantee for future returns.

If you would rather have a slightly lower risk level, there are also countless of portfolios both within crypto, but in particular outside the crypto niche. Read more about how eToro can make crypto trading easier!

Rating: 9.78/10

Minimum deposit: 50 GBP

Description: Trade crypto or currencies with portfolios. It has never been easier to follow the pros. Explore copy trading today!

Risk warning: 68% of private investors lose money when they trade CFDs with eToro.

Published:

Author: Markus Jalmerot

TAGGAR

Other similar news

Below you can see more similar news if you want to learn more about this subject or find related topics.Everybody knows there's a war going on in Ukraine, Russia is trying to take over the country and the...

Recently we've seen headlines all across the globe shouting about how Russia is preparing to invade ...

It's been roughly 2 years since the start of the Corona pandemic, one of the biggest events in moder...