Players in the currency market

There are various players in the giant foreign exchange market that have a turnover of 6.6 trillion dollars per day and they are all important in one way or another. In this chapter, we look at each of them and describe their main attributes and responsibilities in the overall foreign exchange market which is open 24/7 from Monday to Friday.

Interestingly, internet technology has really changed the existence and way of working of currency trading. These players now have easier access to data and are more productive and fast when it comes to offering their respective services.

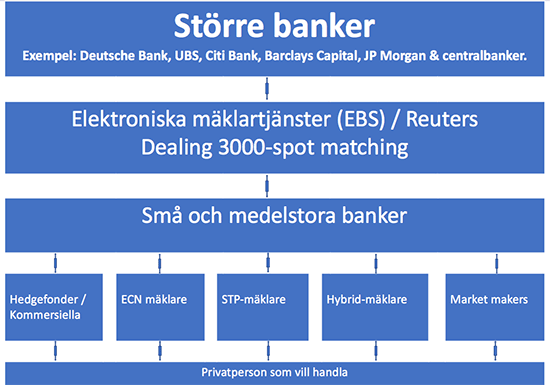

Capitalisation and sophistication are two important factors in categorising the foreign exchange market players. The sophisticated factor includes money management techniques, technical level, research ability and discipline. For the capitalised factor, the players higher up the list are normally more capitalised, although hedge funds and some forex brokers may have real collateral. Given these two broad measures, there are six major foreign exchange market players. The following figure shows the different foreign exchange market players in terms of the volume they handle.

Table of Contents: Overview

Which are the participants?

• Commercial and investment banks: At the top of the hierarchy are the commercial banks together with the central banks. Deutsche Bank accounts for just over 18% of the volume, UBS for 11.3%, Barclay Capital for 11.1% and Citibank for 7.7%. Then RBS comes in at 6.5% market share, JP Morgan has 6.35%, HSBC is at 4.55%, Credit Suisse has 4.4%, Goldman Sach has only 4.4% and Morgan Stanley 2.9%. Funny facts: Did you know that Donald Trump used to have Deutsche Bank, before they required that he finds a new bank?

• Centralbanker: Volumes vary widely for central banks, but they may be the largest participants for certain currency pairs at some point in time. With almost unlimited reserves, it is tough to meet a buying or selling bank and it is often best to just turn your back on them. Some well-known central banks include the Swedish Riksbank, which was founded as early as 1668 and is the oldest central bank in the world. 26 years later, the British started the Bank of England. The Norwegian Riksbank (Norges Bank) was not established until 1816, while the US Federal Reserve was created in 1913. The European Central Bank, ECB, was not established until 1998, a year before the release of the Euro.

• Electronic Brokerage Services for Banks: So-called “Electronic Broker Services” (EBS) are available for major banks, through Reuters Professional or from Bloomberg Professional. Each terminal costs $ 35,000 per year from Bloomberg and it is normally required to set up a number to be allowed to get started.

• Fund managers, hedge funds and sovereign wealth funds: Funds are also very dependent on being able to trade in the foreign exchange market. There are occasional substantial transactions from these players in the foreign exchange market.

• Internet-based trading platforms: A number of different trading platforms account for significant volumes, especially MetaTrader 4 and the slightly newer MetaTrader 5. Sites such as NS Broker build all their trading on an established and advanced trading platform, MT5, instead of creating their own platform that is significant more time consuming. British IG, which has been around for 30+ years, has both a good own platform, as well as MT4.

• Currency brokers-retailers: Private individuals trade currencies primarily through international and British forex brokers. One of our favorites is the Scandinavian-based player Skilling, which has a sophisticated and transparent, featured platform – but also offers cTrader and MT4 as alternatives.

Commercial banks and investment banks

Banks need no introduction, they are ubiquitous and numerous. Their role is crucial in the Forex network. Banks participate in the foreign exchange markets to neutralize their own and their customers’ currency risks. Banks are also trying to multiply their shareholders’ wealth.

Each bank is different in terms of organization and work policy, but each of them has a hand counter that is responsible for order management, market creation and risk management. The trading desk has a role when it comes to making money by trading currency directly through hedging, arbitrage or mixed financial strategies.

There are many types of banks in a foreign exchange market; they can be huge or small. The largest banks trade in large amounts of funds that are traded at any one time. It is a common standard for banks to trade in 5 to 10 million dollar packages. The largest even handle $ 100 million to $ 500 million packages. The following picture shows ten of the largest participants in the foreign exchange market.

Central banks

A central bank is the dominant monetary authority of a nation. Central banks follow individual economic policies. They are usually under the authority of the government. They facilitate the government’s monetary policy (it is about keeping supply and supply of money) and making strategies to offset the ups and downs in the value of their currency.

We have previously discussed the reserve assets. Central banks are the bodies responsible for holding foreign currency called “reserves” or sometimes “official reserves” or “international reserves”. You can see real-time exchange rates here.

The reserves held by the central banks of a country are used to manage foreign policy. The reserve value indicates significant attributes about a country’s ability to pay foreign debts. It also affects the nation’s credit rating measures. The following picture shows the central banks in different European countries.

Elektronic brokerage services for banks

So-called “Electronic Broker Services” (EBS) are available for larger banks, through Reuters Professional or from Bloomberg Professional. Each terminal costs $ 35,000 per year from Bloomberg and it is normally required to set up a number to be allowed to get started.

Businesses

Not all participants involved in the foreign exchange market have the authority to set prices for the currency as market guarantors. Some of the players only buy and sell currency at the prevailing exchange rate. They may not seem so significant, but they make up a large part of the total volume traded on the market.

There are companies and companies of different sizes; they can be a small importer / exporter or a significant influencer with a cash flow of several billion dollars. These players are identified by the nature of their business policies which include:

(a) how they receive or pay for the goods or services they usually provide; and

(b) how they engage in business or capital transactions that require them to either buy or sell foreign currency.

These “commercial traders” aim to use financial markets to offset their risks and secure their operations. There are also some non-commercial merchants. Unlike commercial traders, the non-commercial ones are considered speculators. Non-commercial players include large institutional investors, hedge funds and other business units that trade in the financial markets for profit.

Fund managers, hedge funds and more

This category is not involved in defining prices or controlling them. They are basically asset managers. They can trade currencies for hundreds of millions of dollars, because their portfolios of mutual funds are often quite large or completely gigantic. Some examples could Blackrock, Fidelity, Splitan Fonder or Öhman’s fonder.

These participants have the management regulations and obligations towards their investors. The main purpose of hedge funds is to make profits and grow their portfolios. They want to achieve absolute returns from the Forex market and dilute the risk. Liquidity, leverage and low costs to create an investment environment are the advantages of hedge funds.

Fund managers invest primarily on behalf of the various clients they have, such as pension funds, individual investors, governments and even central bank authorities. Wealth funds that manage state-sponsored investment pools have increased rapidly in recent years.

Internet baserad trading platforms

The Internet is an impersonal part of the foreign exchange markets today. Internet-based trading platforms do the task of systematizing customer / order matching. These platforms are responsible for being a direct access point for collecting pools of liquidity.

There is also a human element in the mediation process. It covers all persons who are engaged from the moment an order is added to the trading system until it is processed and matched by a counterparty. This category is handled by STP (straight-through-processing) technology.

Like the prices of a Forex broker’s platform, many interbank transactions are now handled electronically by two primary platforms: the Reuters web-based trading system and Icaps EBS, which is an abbreviation for “electronic brokering system” that replaces brokers as once common in foreign exchange markets.

Forex brokers for individuals

The last segment of the Forex markets, the currency brokers, are usually very large companies with large trading revenues. These companies offer the basic infrastructures for ordinary individual investors to invest, speculate and make money in the interbank market. To offer competitive and popular two-way pricing model, these brokers usually adapt to the technological changes available in the Forex industry. It is usually pointed out that there are 4 different types of currency brokers and here we go through the different options.